In the last decade, online trading has become more common among Online trading: “What is trading and how do you do it?” , investors and traders around the world, thanks to rapid development and easy access to online financial information and tools; thanks also to the emergence of licensed trading platforms, which have made the trading process much easier than in the past.

What’s trading?

Trading is the purchase and sale of financial assets such as shares,Online trading: “What is trading and how do you do it?” , currencies, goods and long-term contracts with the aim of profiting from the difference between the purchase price and the sale price, and we can simply say that trading is a couple of currencies, the currency that they own (the main currency) and the currency that they intend to purchase for your currency (the sub-currency). The most famous of these pairs on trading platforms is the euro/dollar, the principal currency and the dollar, the sub-currency.It’s how many dollars you can buy for one euro.Euro/$1.10 pair price, which means that an exchange of Euro1 will be offset by US$1.10.

If you think the price of the euro will rise against the price of the dollar in the next 48 hours, you will buy the euro against the dollar you own. If you expect it right and the price of the euro will rise, you will sell it. The difference between the price of the old euro and its new price will be the amount of your profits, so it will be traded over the Internet.

How’s the trade going?

There are many different ways to trade foreign exchange, but they all work the same way, buying another currency and selling at the same time.

- Traditional circulation: Currency circulation was done through a traditional medium, but now that online trading platforms have emerged, it is possible for anyone to trade wherever they may be.

- Daily and international circulation: Governments, companies and even private individuals trade in currencies every day.

The trading methods, instruments and strategies used vary between the financial markets and the financial assets that are traded, as well as the objectives of the traders, their experience and the level of risk they wish to bear. Traders can use basic analysis, graphic analysis, technical analysis and other strategies to make the right trade decisions.

How do you start making money from online trading?

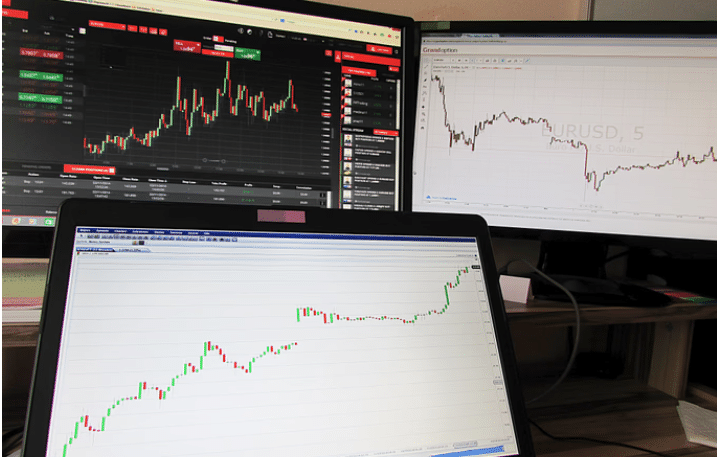

Financial markets such as stock exchanges, currency, and goods are usually traded, but with the advent of licensed online trading platforms it has become easier to trade and gain online.All you have to do is follow the steps in order to start your business in circulation.

- To open a private account for trading on one of his platforms like Metatreder (one of the best trading platforms for foreign currency), and then write all your information required.

- Deposit the money you want to trade on the trading platform.

- After an analysis of the market and currencies and the expectation that the currency will rise or fall, you can open a deal, and the opening of deals is different from one platform to another, but it’s not difficult.

- If you notice the price moving against your expectation, close the deal immediately so as to limit the loss of your money.

- If you move with your expectation, wait until you reach the target profit and then stop the deal and take your profits.

What types of online circulation are available?

Trading is a very wide area with several types, divided by the time the transaction is made and where and how it is traded.

- Today’s circulation: It’s a kind of trade where coins are bought and sold on the same day, and often profits are made from small price changes during the day, and blame trading is your best option if you’re a starter trading that invests in a small mine.

- Long-term trading: a trade in which financial assets are purchased and held for a long period may extend to several months and years, and profits from increased assets are often realized over time, and such trading takes place in large companies and banks.

- Robotics is a form of deliberation in which computers and software are used to analyse data and make investment decisions and profits are realized faster and more effectively.

- Online trading: It is a form of deliberation in which the Internet is used to access electronic trading platforms and traders can easily purchase and sell at any time of the day.

- Collective deliberation: It is a form of deliberation in which ideas, strategies and information are shared among Internet users and traders can benefit from the experiences of others and share opinions and knowledge to improve their trade outcomes.

4 trading platforms with lowest fees

Although trading is a good choice to make money, it must be borne in mind that if the platform you’re working on is unsafe, there are four best-known safe trading platforms.

- Binance: It is one of the largest digital exchange platforms in the world with more than 120 million users and a circulation volume of more than 120 billion a day. This platform is your best trading option. It provides you with stronger graphs and schemes than competition platforms. It also examines and analyses the market.

- Coinbase: It is one of the most famous and powerful trading platforms that provides high protection to its clients, and it contains large market indicators and graphs to analyse market mobility and offers trust accounts to beginners to protect them, and best investment advice to them.

- The eToro platform is a global trading platform that allows for the deliberation of a wide range of assets, one of the features of which is that it provides good learning sources for deliberation such as news and analysis and is also user-friendly.

- Bistininvest: It is one of the best trading platforms for beginners, offering services to thousands of clients, special tutorials for each client, in-depth market research, and no minimum deposit.

Are there any Arab trading platforms?

The answer is yes, there are Arab trading platforms that are more reliable and secure for Arab trading than any other platform.

- Exence platform: One of the best platforms in the Arab world is considered to be the lowest deposit of $10, as it is characterized by an experimental account that you can train without money.

- The evest platform is also a well-known Arab platform with the lowest deposit amount of $250.

Main factors affecting the trading market

There are many factors affecting the trading market, the most important of which are:

- Economic and political news: The trade market is greatly influenced by various political and economic events such as wars, economic crises and changes in interest rates.

- Changes in supply and demand: The trading market is greatly affected by changes in supply and demand for different financial assets where supply shortages or increased demand can increase the prices of financial assets.

- Important corporate advertising: Important corporate advertising such as financial results, quarterly reports and important corporate news can affect associated equity prices.

- Technology and innovation: Technological developments and new innovations affect financial markets where innovative technologies can simplify business processes and improve market efficiency.

- Analysis of graphs: Investors must also look at the analysis of graphs and the analysis of historical price trends of different financial assets to predict future prices.

You might like :

- How to create a successful YouTube channel: tips for a strong YouTube presence

- The rivalry between Gemini and ChatGpt.. Is staying stronger or smarter?

- AI Image Modification

- Every genius has benefited from chatgpt technology to develop your business

- The most important courses you should learn to keep up with development in the coming years

- 7 out-of-the-box ideas for YouTube channel that are successful and the most important ways to succeed

- AI is a skilled doctor in the diagnosis of sleep respiratory disorder

What are the features of online trading?

Trading has been able to obtain many of the advantages that have made it the best business to profit from the Internet, and its features:

- Momentary execution of trading orders: Exchange transactions are made immediately, whether you are a buyer or a seller, because of the high liquidity on these platforms and the availability of vendors and buyers at all times.

- Any person can learn and start trading at any time: prior to the advent of online trading platforms, the circulation was limited to large investment and commercial banks and companies, and it was difficult to find out how the trading took place, but after the emergence of these platforms and the spread of trading courses, it became possible for anyone to start it and make substantial profits from it.

- Exchange trading is open 24 hours: the currency market continues to struggle between up and down 24 hours a week, allowing anyone to open any deal at any time.

- The possibility of trading in small amounts: Thanks to the labour market ‘ s financial leverage system, individuals are able to trade in currencies in small amounts after being limited to large traders, banks and financial institutions. You can trade in amounts not exceeding hundreds of dollars.

- The ease of opening an account on trading platforms and starting directly: due to the emergence of online trading platforms and the availability of Internet networks in all countries and homes now, a simple trader can open an account on these platforms by recording some simple information that will be requested from him on the platform that is being registered and depositing a sum of money on this platform so that he can use it in his dealings and start trading directly.

What are the risks of online trading?

- The exchange of currencies using the crane is a high risk. To the extent that profits can be realized, there may be heavy losses if the currency market moves counter-expected.

- Weakness of the supervisory or regulatory aspect: the currency market is an OTC market, i.e., an off-market market that does not have a stock market that regulates its operations to the same extent as the stock market, so caution must be exercised and intermediaries carefully selected so that you are not scammed and your money stolen.

Eventually.

It can be said that trading is one of the main activities in the financial markets and is characterized by acceleration, constant price change and significant fluctuations in the market value of financial assets. Traders can make large profits by investing in assets that they expect to increase in future prices and selling when their value rises, but on the other hand, traders are also at risk of losing capital if they expect wrong price movements, so they must learn how to manage risks and identify potential losses.

Although online commerce gives traders faster and easier access to financial markets, they must also learn how to use trading platforms properly and make use of available tools and resources to improve their performance.